Final Expense

What Is Final Expense Insurance?

Affordable Premiums

No Medical Exam

Ease the Burden of Final Costs

Final expense insurance, also known as burial insurance, is a small whole life policy that helps pay for funeral costs, medical bills, or unpaid debts — easing the financial burden on your family during a difficult time. Funerals can cost anywhere from $7,000 to $15,000. Final expense insurance helps your loved ones cover these costs without dipping into savings or going into debt.”

How it works

Which Plan Fits Your Needs?

Guranteed Issue

No health questions. Acceptance guaranteed. Perfect for those with health concerns or who want guaranteed approval.

Simple Process

A few basic health questions. Higher coverage amounts. A great balance of affordability and ease.

Final Expense Insurance

Affordable coverage to help your family handle funeral costs, medical bills, and other end-of-life expenses.

Learn More

Guaranteed Issue

Get coverage with no health questions asked — approval is guaranteed, making it an ideal choice if you have existing health concerns or want a simple, worry-free way to protect your family.

Who It’s For

- Seniors with medical conditions

- Anyone who wants guaranteed approval

- People who may not qualify for traditional life insurance

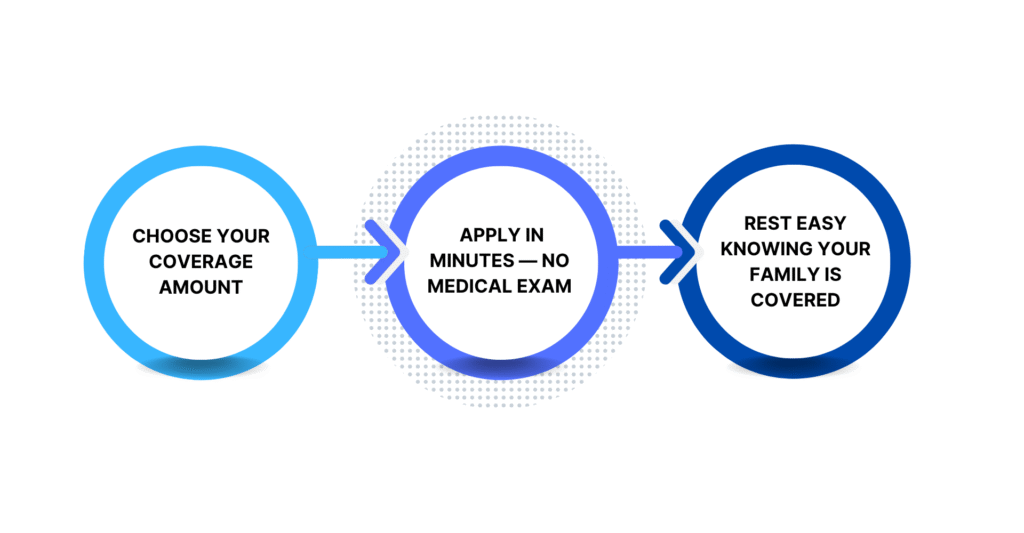

How It Works

- Choose your benefit amount

- No medical exam, no health questions

- Fast approval — get covered in minutes

Simple Process

A great balance of affordability, easy approval, and higher coverage amounts. With just a few simple health questions, you can qualify for more coverage at a better rate than guaranteed issue plans.

Who It’s For

- People in good health who want higher coverage

- Those who want simple approval without a medical exam

- Adults planning for their family’s future needs

How It Works

- Answer a few quick health questions

- No medical exam required

- Get affordable rates and flexible coverage

Final Expense Insurance

Final expense insurance is designed to help your loved ones pay for funeral costs, medical bills, and other end-of-life expenses, so they aren’t left with unexpected debt during a difficult time.

Why It’s Valuable

- Covers funeral and burial costs

- Helps pay off final medical bills

- Provides peace of mind for your family

How It Works

- Choose your benefit amount (typically $5K–$25K)

- Simple application — no medical exam needed

- Fast payout directly to your beneficiary

"When my mother passed her made everything easier. I coud grieve without financial stress"

“Not sure which plan is right for you? Talk to a licensed agent today or get a fast quote — no obligation.”